Doing Business Here

Join our 14,000+ businesses thriving in Greater Fargo Moorhead

Business

Rank for Business Friendly State in 2022

#

0

Top Ten State to Survive A Recession in 2022

#

0

Best State To Start A Business In 2023

#

0

Size of The Market

With a regional population of over 261,600, the Fargo-Moorhead area is home to students, fresh talent and experienced professionals.

Growth of the workforce

In the last 20 years, the Fargo-Moorhead area's labor force has grown three times the national rate. More than 58,000 millennials call the metro home, 7,000 more than the national average for an area this size.

Companies Succeed Here

The best indicator of success in a region is seeing examples of companies in your industry that have found success. And you'll find plenty of success stories here.

Relocate & Expand

The Fargo-Moorhead metro is advantageously placed at the crossroads of 2 federal interstates, I-94 and I-29, giving the community access to interstate trucking distributions and logistics options.

You can do business anywhere these days. And there’s no better place than Greater Fargo Moorhead. The economy is strong, public policies are business-friendly, transportation access and connections are exceptional, and the workers are smart, reliable and dedicated!

Explore the various incentives, workforce programs, and financing options available in our region in our latest Smartbook.

Higher Education in Fargo Moorhead

Fargo Moorhead is home to three world-class universities and two technical colleges, drawing more than 21,000 college students for top-ranking programs, research opportunities, and commercialization.

North Dakota State University is an R1 research institution, designated by the Carnegie Classification of Institutions of Higher Education, putting NDSU in the same league as the nation’s top research institutions.

Fargo Moorhead Economy Overview

The size of the Greater FM economy has increased by 180% over a 20-year timespan from 2001 to 2021 growing from a GRP of $6.03 billion to over $16.8 billion in 2021. During this time the labor force has also grown by a significant 39% (3 times the national average of 13%).

| Year | GRP for MSA | Labor Force for MSA |

|---|---|---|

| 2021 | $16,862,478,814 | 143,311 |

| 2016 | $13,363,421,865 | 135,585 |

| 2011 | $9,854,022,984 | 124,038 |

| 2007 | $8,330,231,625 | 118,980 |

| Year | GRP for MSA | Labor Force for MSA |

|---|---|---|

| 2007 | $8,330,231,625 | 118980 |

| 2008 | $8,715,176,377 | 121262 |

| 2009 | $8,955,846,754 | 120897 |

| 2010 | $9,249,659,294 | 122904 |

| 2011 | $9,854,022,984 | 124038 |

| 2012 | $11,224,911,422 | 124141 |

| 2013 | $11,560,102,566 | 125253 |

| 2014 | $12,466,605,502 | 127044 |

| 2015 | $12,967,382,771 | 130246 |

| 2016 | $13,363,421,865 | 135585 |

| 2017 | $13,757,812,505 | 138999 |

| 2018 | $14,420,259,038 | 139895 |

| 2019 | $14,786,265,114 | 141915 |

| 2020 | $14,890,017,771 | 142871 |

| 2021 | $16,862,478,814 | 143311 |

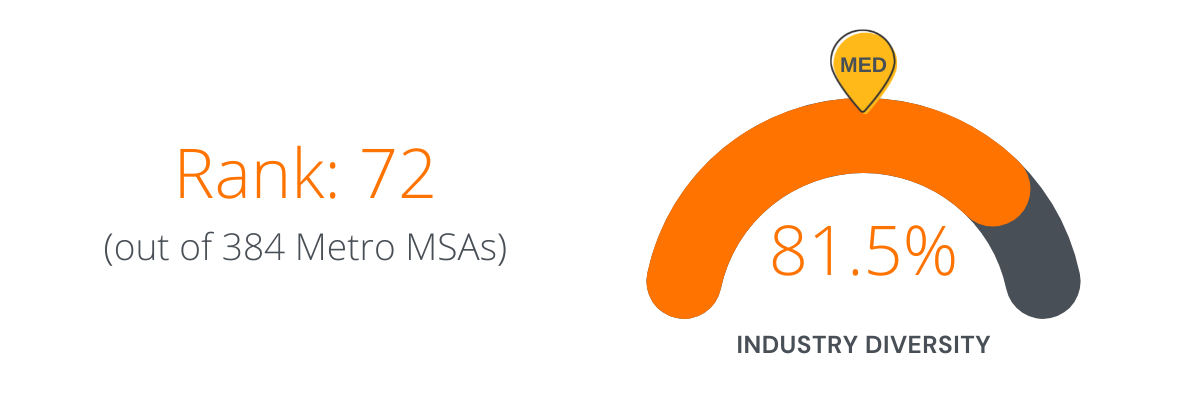

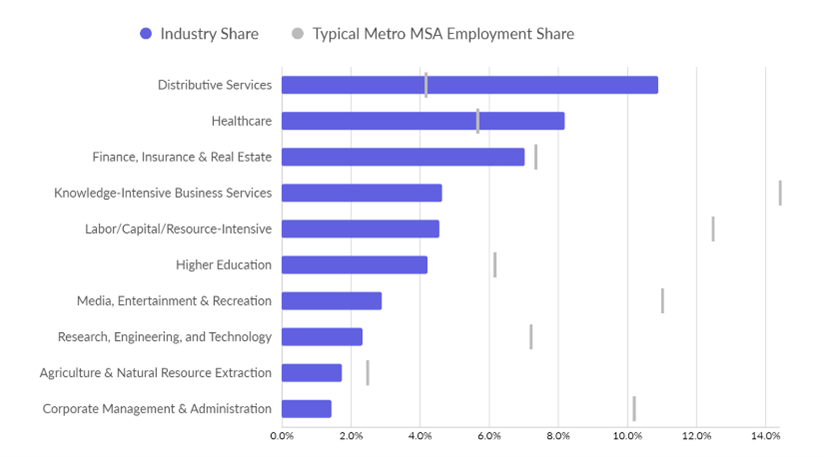

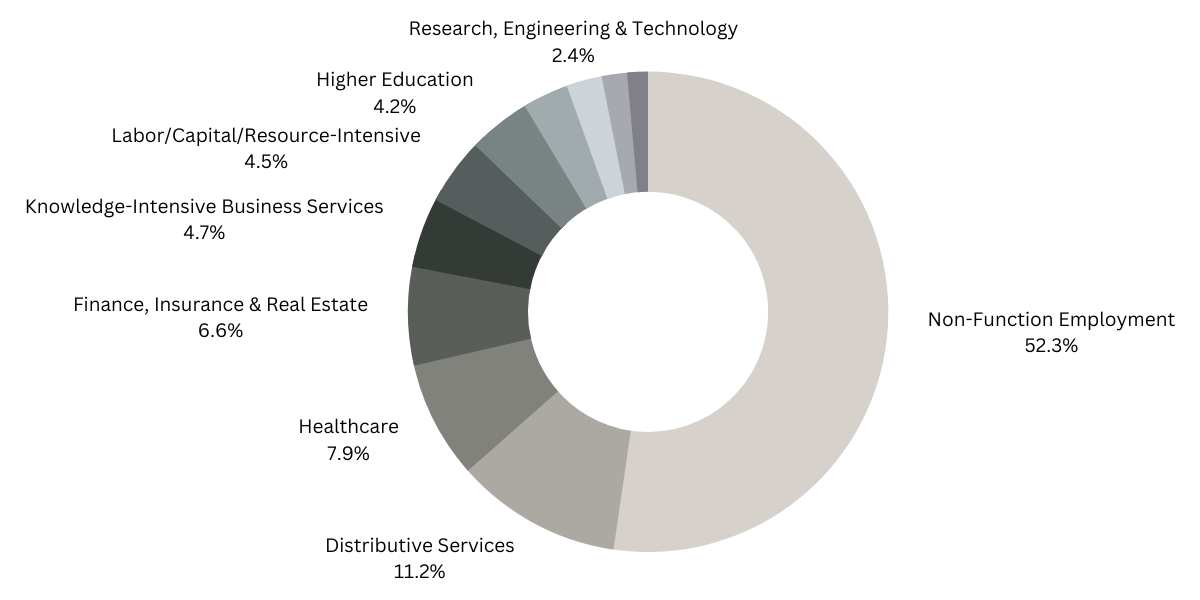

Industry Diversity Snapshot

The Fargo Moorhead metro ranks 192nd in population, (putting us in the top 50% of all metros) while at the same time, our industry diversity puts us in the top 19% of all metros. Fargo Moorhead benefits from highly diversified sectors. This means that employment is distributed more evenly between the 11 industry clusters compared to the typical Metro. A region with high diversity can signal economic stability and more easily withstand economic pressures, while a region with low diversity can signal economic instability.

Industry Diversity

Industry Share

Industry Cluster

How the GFMEDC Will Help Your Company

Fargo-Moorhead is a Smart Move for companies looking for a new location or a business-friendly place to expand. We’re happy to help.

Every industry and every company are different so we’ll provide customized information and services to meet your needs.

We Will:

- Provide all the information you need about doing business in Fargo-Moorhead, the community and quality of life.

- Help access local and state incentives for new businesses.

- Help quantify savings from incentive programs and compare them to the costs of other locations your company may be considering.

- Help identify a specific location or property.

- Connect you to local suppliers, vendors and university resources that can contribute to your company’s success.

- Provide tours of the community and potential business locations for representatives of your company.

- Provide tours of the community for spouses.

- Once you decide Fargo-Moorhead is the place for your company or new satellite operation, we’ll help your team integrate into the community.

Corporate Taxes

The Fargo Moorhead region is made up of large and small cities from two different states. Tax information for each state varies. To learn more, check out:

Fargo-Moorhead area has high impact capital resources and incentives

Testimonials

“It’s critical for us to have certainty of delivery with our projects. The Greater Fargo-Moorhead Economic Development Corporation, City of Fargo, and other regional partners not only helped us achieve our goals, but they did so with speed and precision. These local partners felt like an extension of our team, understanding the tight deadlines and approval processes to get the project into the ground. They provided solutions when we were presented with challenges and leveraged their resources to provide measurable progress. We couldn’t be more pleased with the support we received from our economic development partners in the Fargo-Moorhead area and their cooperative nature. We look forward to doing more business in Fargo and surrounding communities.”

Dan Mueller

Ryan Companies

“I would tell anyone who’s planning to move a startup company to an area that fosters and promotes the growth of a startup company that Fargo’s a great place.”