The GFMEDC-administered Growth Initiative Fund (GIF) approved seven loans during the first quarter of 2021. Six of the loans were in conjunction with Bank of North Dakota’s PACE/Flex PACE program, which provides lowered interest rates to assist expanding companies. One of the loans was through the GIF’s Early Venture Microloan Program.

The GIF loan approvals totaled $553,000 and provide the opportunity for these primary-sector companies to access approximately $933,000 in matching state interest-buydown grant funds.

The primary sector companies utilizing these programs this past quarter are:

- 3DOMFuel – a Fargo manufacturer of filament used for 3D printing

- Access Point Technologies (2 loans) – a medical device manufacturer opening a facility in Horace to design, manufacture and test innovative treatments for atrial fibrillation

- International Marketing Systems – a Fargo e-commerce company that produces and sells a variety of products, with a concentration primarily in rope, cord, paracord, yarn and string

- PRx Performance – a Fargo manufacturer and supplier of high quality exercise equipment, specializing in home-gym systems

- Red E – a Fargo manufacturer and engineering consultant, that specializes in the after-market ag parts

- Stax Financial Technologies – a fintech startup developing in the niche of consumer knowledge of Environmental, Social, and Corporate Governance practices

The total capital investments made by these projects equal approximately $43.5 million, with an estimated creation of 115 new jobs and an addition of 199,000 square feet of new space.

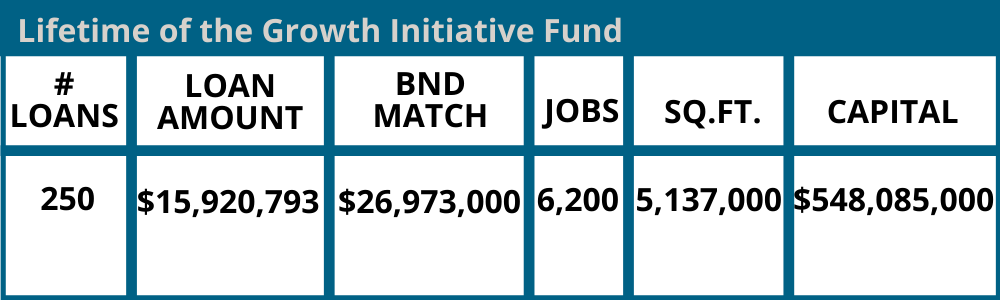

Currently, the GIF is managing 82 active loans with a total loan balance of $5.57 million. Over the lifetime of the fund, the GIF has funded 250 loans in Cass County for a total of $15.9 million.